Updated: June 2025

Deciding on the right life insurance plan for your family is definitely a challenging but worthwhile task.

There are so many different life insurance policies to consider that it can be difficult to make a choice that will be suitable for your family’s particular situation.

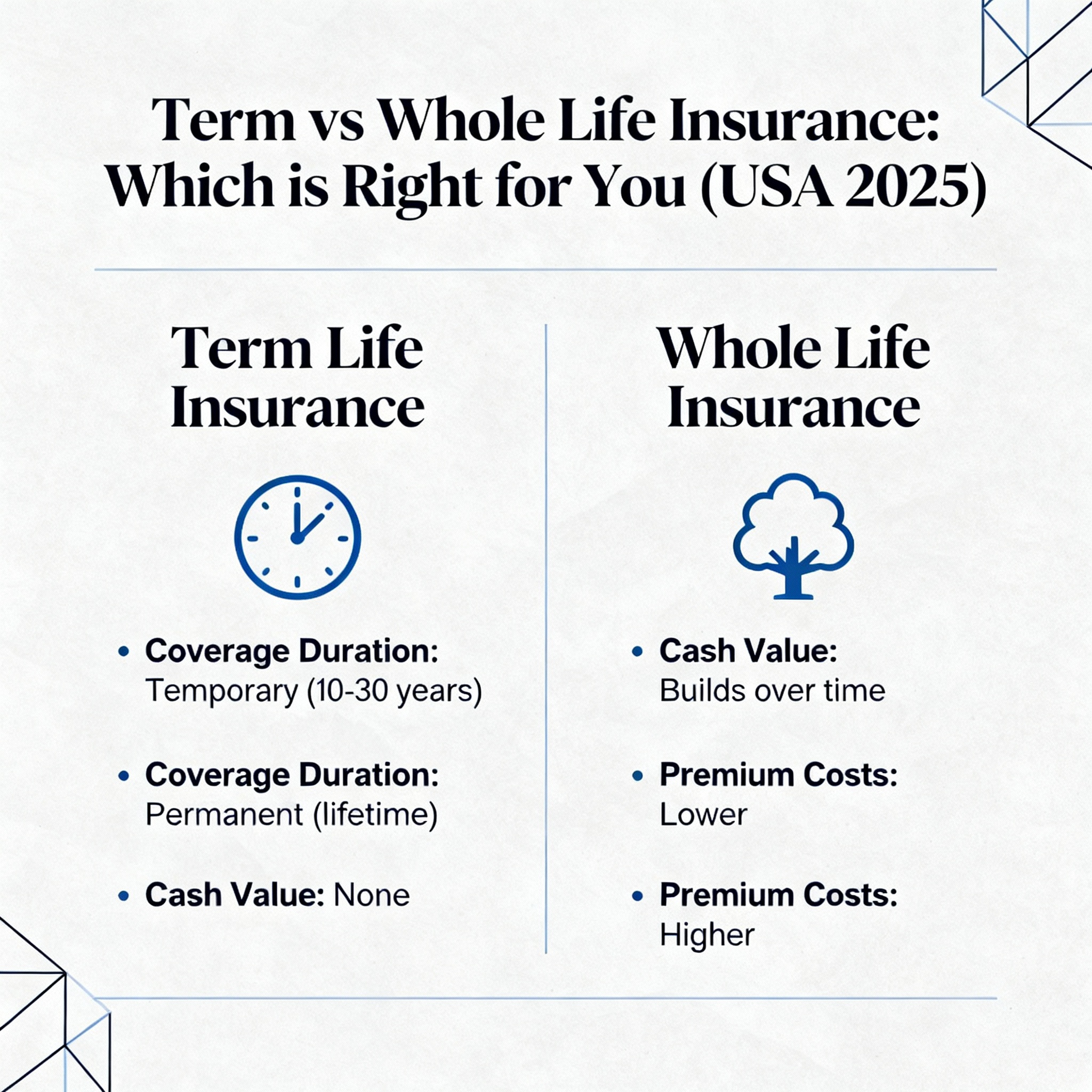

You can, for example, pick from between term plans or whole life insurance. The rest of the text will guide you through these two basic types of insurance, tell you how term and whole life insurance differ, list pros and cons as well as give you illustrative cases which happened in 2025.

🧾 What Is Term Life Insurance?

Term life insurance is a life coverage which is given for a specified time period that is usually in terms of 10, 20, or 30 years.

If the event of death occurs during this timeframe, the insured person’s beneficiary get the death benefit (the payout). However, in the case of the policyholder living beyond the stipulated term, the insurance policy is abandoned, and there is no financial burden on the company or individual.

✅ Pros:

- Cheap policy (especially for the youth and fit)

- No moving parts—they are simple to understand

- Best for short-term financial security only. Like repaying mortgage and financing the children’s education

❌ Cons:

- Closure where the term expires

- No financial value or investment part

📌 Example:

John is a 30 years old man who bought a 20-year term policy where he has a $500,000 benefit. He is charged about $25/month. In case John dies within 20 years, his family receives $500,000. However, if John lives until he gets 50, then the policy period ceases.

🏦 What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that will cover you for your entire life, if the payment of the premiums is regularly done. This insurance policy has a cash value account that accumulates over time and can be covered on an interest-free loan basis. Elasticsearch is a distributed focused full-text search en

✅ Pros:

- Original search results that match the user’s query

- You are allowed to take a loan out of the cash value.

❌ Cons:

- Much more expensive than term life

- Complexity: part insurance, part investment

📌 Example:

For example, Sara, 30 years old, purchases a $500,000 whole life insurance policy; the monthly cost is around $350. The non-insurance portion of the premium is invested and can be used by the policy owner for a loan in the future.

🔍 Key Differences at a Glance

| Feature | Term Life | Whole Life |

|---|---|---|

| Coverage Duration | 10–30 years | Lifetime |

| Monthly Premium | Low | High |

| Cash Value | ❌ None | ✅ Yes |

| Flexibility | High (easy to cancel/change) | Low (locked structure) |

| Best For | Young families, short-term goals | Long-term estate planning |

🤔 Which One Should You Choose?

👉 Choose Term Life Insurance if:

- You would require a covering protection that you can afford from now

- You are the family’s head and are still in the period of your children attending school

- Your aim is straightforwardness in everything you do

👉 Choose Whole Life Insurance if:

- You desire continuity of your life-time protection

- Especially you are the owner of a business and you need the resources of this type for business development

- You have saved enough money and now you find that you can also pay higher monthly installments of the policy

💡 Expert Tip (2025 Update)

In 2025, a large portion of the US citizens are blending the two coverages:

“One should consider having a significant term life policy to ensure financial protection for dependents, and purchasing a permanently low life policy that will act as a store of value to provide a guaranteed benefit to the family, paying a small annual premium.”