Published: June 2025

Buying a house is among the largest investments you will ever take. To protect that investment, many homeowners think about both homeowners insurance and a home warranty. However, these two tools are the most valuable when the needs, they are to be met, are different.

Let’s explain to you all the things they cover, mechanisms of their operation, and the most intelligent approach when it comes to both.

🔍 What Is Homeowners Insurance?

Homeowners insurance is a policy that provides coverage for your house and your personal belongings in the event of accidental or unexpected events like:

- Fire or smoke damage

- Wind or hail storms

- Thorough robbery or vandalism

- Liability if someone gets injured on your property

💡 Homeowners insurance is mandated by mortgage lenders in the U.S.

🧾 What It Typically Covers

- Your house structure (walls, roof, foundation)

- Detached structures (garage, shed)

- Personal belongings (furniture, electronics, clothes)

- Liability coverage (legal/medical costs if someone is injured)

- Temporary living expenses if your home is uninhabitable

⛔ What’s Not Covered:

Floods, earthquakes, routine wear and tear, and poor maintenance issues.

🛠️ What Is a Home Warranty?

A home warranty is a service contract, but it is not insurance. The home warranty is covering the repair and replacement of essential home systems and appliances that breakdown due to normal wear and tear, e.g.:

- HVAC systems

- Electrical and plumbing systems

- Kitchen appliances

- Washing Machine and Dryer are two of the utmost essential home appliances that have brought a remarkable convenience to the house.

💡 You can think of it as a cushion that saves you from the unexpected breakdown of your home’s aging equipment.

🧾 What It Typically Covers

- Mechanical systems (e.g., heating, air conditioning)

- Appliances (refrigerator, oven, dishwasher, etc.)

- Optional add-ons: pools, spas, well pumps

⛔ What’s Not Covered:

Damage resulting from structural problems, acts of nature or those that occurred due to improper maintenance.

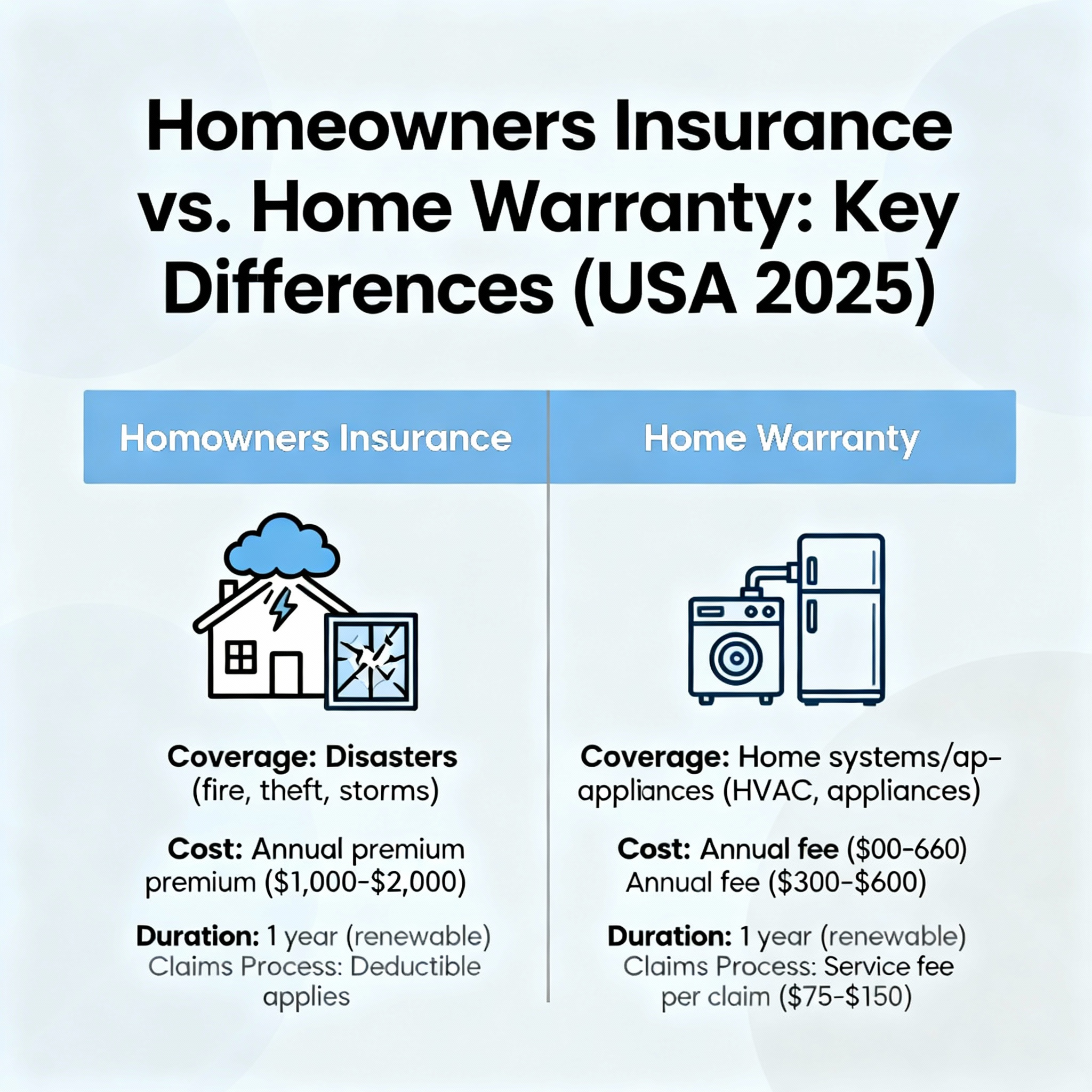

🆚 Key Differences: Insurance vs. Warranty

| Feature | Homeowners Insurance | Home Warranty |

|---|---|---|

| Type | Insurance Policy | Service Contract |

| Required by Lenders | ✅ Yes | ❌ No |

| Covers | Damage from disasters, theft, liability | Repairs of systems/appliances due to aging |

| Examples of Use | Roof replacement after a storm | Fixing a broken dishwasher |

| Payout | Reimbursement for losses | Technician service + covered repair/replacement |

| Cost | ~$1,200/year (varies by location) | ~$300–600/year + service call fee |

🧠 Should You Purchase Both?

If you’re the owner of a house for the very first time or have just bought a second-hand one, having a home insurance policy and a home warranty will give you full coverage:

- Insurance safeguards your wealth

- Warranty helps you to avoid sudden breakdowns by not spending much

📌 Pro Tip: Some home sellers put a 1-year home warranty in the sale—ask before you buy