Published: June 2025

Finding the correct health insurance can be a challenge, but the arrival of the Health Insurance Marketplace has brought the process to be more straightforward, less hidden, and open to millions of Americans.

No matter if you are freelancing, not employed, or simply in need of an affordable health plan, you can still apply for health insurance through the Marketplace in 2025, thanks to this guide.

🩺 What Is the Health Insurance Marketplace?

The Marketplace, which is also known as the Exchange, is a government-enacted tool conceived according to the principles of the Affordable Care Act (ACA), demanding that both the users and the service providers would:

- Compare plans and their benefits

- See if they meet the requirements for a discount

- Sign up for an insurance policy that is affordable and high in quality

You can apply through the federal site HealthCare.gov or find the location of your state’s exchange if, for example, it operates under the name Covered California or New York State of Health.

✅ Who Can Use the Marketplace?

Only inhabitants of the United States can apply to this marketplace.

- Live in the U.S.

- Be a U.S. citizen or legal resident

- Not be incarcerated

- Not have access to affordable employer-based insurance

If you are dealing with the situation of being without a job, pregnant, or have an existing health issue, this will not prevent you from getting coverage.

When to Apply: Marketplace Enrollment Periods

| Period | Dates for 2025 |

|---|---|

| Open Enrollment | November 1, 2024 – January 15, 2025 |

| Special Enrollment | If you have a qualifying life event (e.g., job loss, birth of a child) |

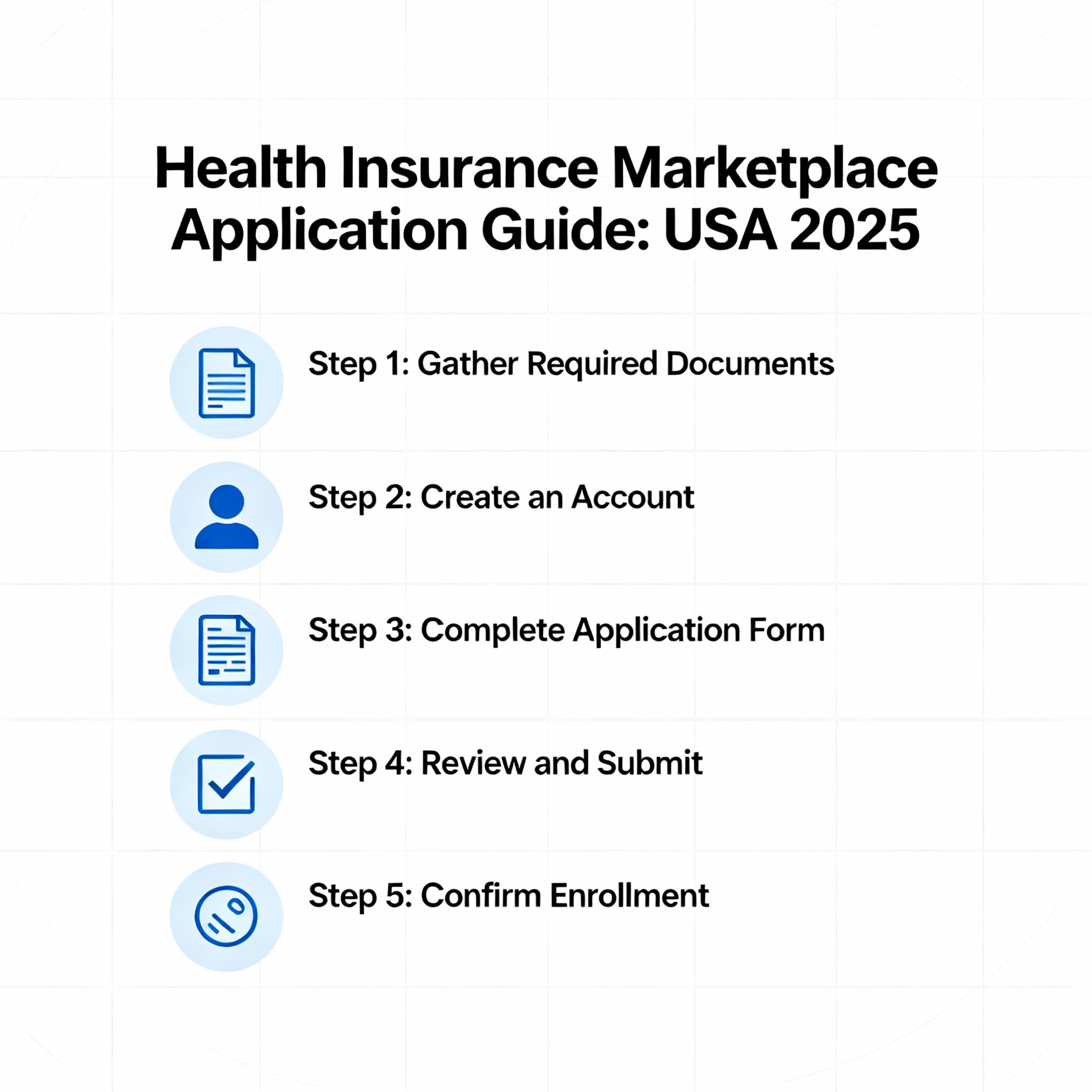

🛠️ Step-by-Step: How to Apply for Health Insurance on the Marketplace

1. Create an Account on HealthCare.gov

Visit www.HealthCare.gov and click “Start a New Application.”

You will need:

- Name

- Date of birth

- Social Security Number

- Email address

2. Enter Your Household Information

You will be prompted for:

- Income details

- The number of people in the household

- Physical address and contact number

This way, the Marketplace will be able to assess if you are eligible for financial help.

3. Compare Available Health Plans

There are different plan levels for you to choose from:

- Bronze: The cheapest monthly premiums, yet more of the expenses will be your responsibility.

- Silver: Premiums are moderate, and you will have to share the cost.

- Gold: More expensive premium-wise, but the out-of-pocket will be lower.

- Platinum: The top premium plan that provides the highest level of coverage.

✅ Apply filters to compare:

- Cost of the premium

- Deductibles

- Drug coverage

- Preferred providers

4. Check for Financial Help

You will know whether you are eligible for the following:

- Premium Tax Credit (reduces your monthly bill)

- Cost-Sharing Reduction (reduces your out-ofChoose the plan that is of benefit to your health and wallet

Make sure the physicians and medications you are about to use are part of the network

6. Submit Required Documents (if needed)You may be requested to upload:

- An affidavit that proves earnings (like W-2 or tax return)

- Immigration documents that indicate your status

- Documents that can confirm the occurrence of a life event (for special enrollment)

If there will be the need for additional documents, you will be sent an email or a text for reminders.

7. Pay Your First PremiumPrior to your coverage coming into effect, you need to make the first payment. This is usually done online through your insurer’s website.

✅ Coverage typically starts the first of the month after you enroll and pay.

8. Keep Your Coverage Updated

- Inform about your earnings situation

- Insert newborns or dependents

- Change your address if you move