Published: June 2025

When a sudden and unexpected disaster damages your home, disaster insurance policy should save you thousands of dollars even if it is about theft, fire, or storm. Besides having the insurance in the first place, knowing how to correctly file a claim is equally important.

It is your step-by-step manual guide that provides all the details of the process of home insurance claim, solve all the possible difficult points and get your payment much faster.

✅ When Should You File a Home Insurance Claim?

You may want to file a claim in the following cases:

- When your policy deductible is less than the cost of damages

- If your insurance policy covers the loss (e.g., fire, theft, water damage, etc.)

- A third party has been injured on your property

📌 Tip: On the off chance that the damage is small and it is below your deductible, it would be better for you to cover it from your own pocket to prevent an increase in premium in the future.

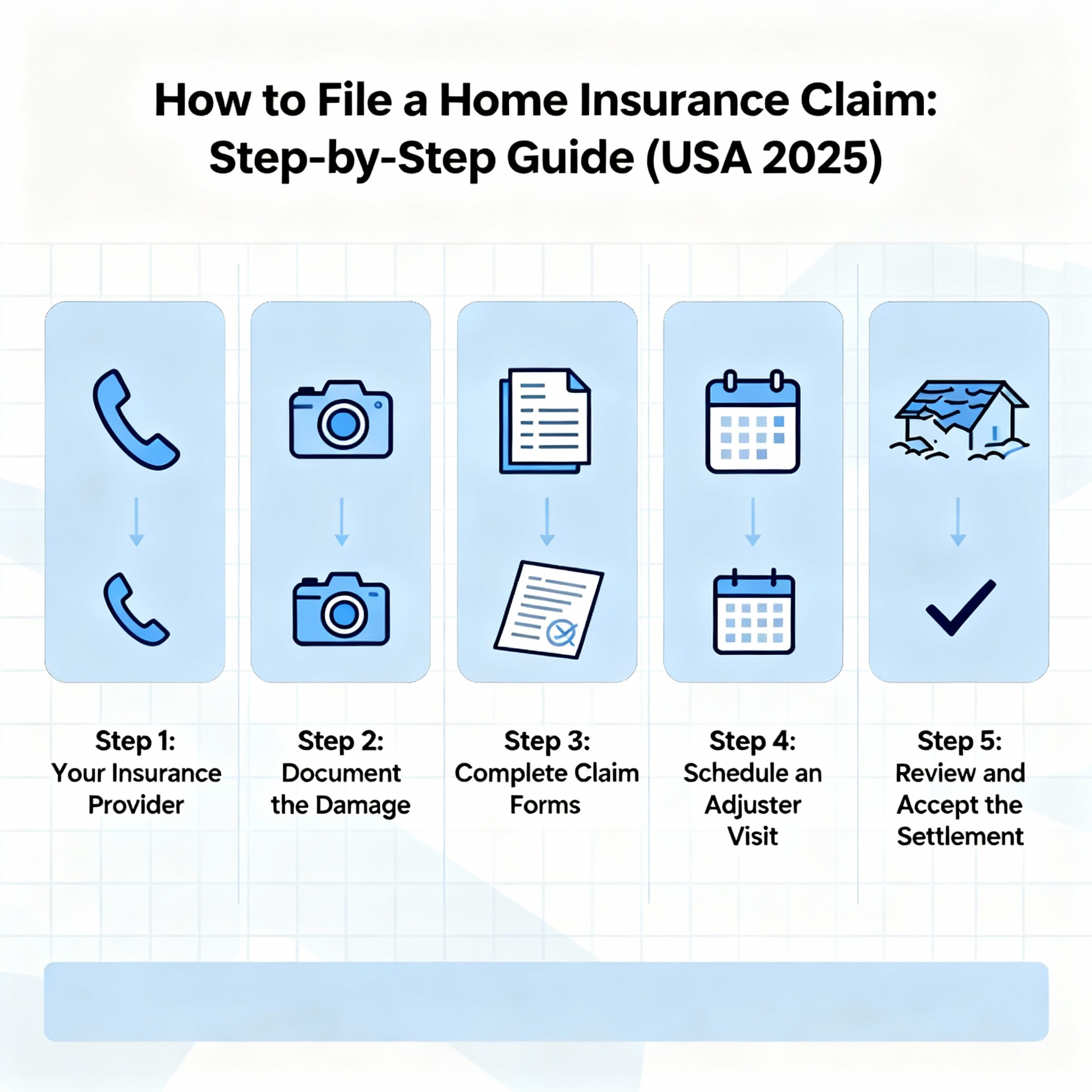

🧾 Step-by-Step: Filing a Home Insurance Claim

🛑 Step 1: Secure the Area and Prevent Further Damage

Do the following before addressing any other issue:

- Switch off water/gas as necessary

- Cover any broken windows with boards or leaks in the roof with tarp/rope

- Take protective measures to prevent further damage

The majority of insurers stipulate that you must react quickly to limit the damage you suffer to a minimum.

📸 Step 2: Document the Damage Thoroughly

Take photos or videos that are detailed and clear of the following:

- The damaged area

- Any personal items that were destroyed

- The outside of your house in case it is touched

Have a record of expenses if you have to make a temporary repair at your own expense.

📞 Step 3: Contact Your Insurance Company

Call your insurance company or use their website or mobile app to file a claim. You should submit:

- Your policy number

- Date and type of incident

- Description of the damage

Your insurer will initiate a claim, and allocate an adjuster to you.

🧑💼 Step 4: Meet the Claims Adjuster

An adjuster will be dispatched to your house to appraise the damage and determine the cost of its repair. Be with the adjuster at that time to:

- Indicate all the areas that need correction

- Ask or answer

- Provide any paperwork

📌 Tip: Record the adjuster’s visit with a smartphone (provided consent is given) or take notes.

📂 Step 5: Get Repair Estimates

While your insurance company will make their own estimate for the repairs, it is recommended to have a few contractors prepare two or three locally-based quotes. This can:

- Help you make a comparison based on prices.

- Enable you to identify lowballing.

- Assist you in selecting the most requisite contractor.

💰 Step 6: Review the Settlement Offer

Once your claim has been assessed, the insurance company will send you a proposal for settlement. Typically, it contains:

- The amount that was considered

- Deductible that was not claimed

- What is not included (if there is any)

If you find the need to, you may accept, negotiate or dispute the offer.

🧱 Step 7: Repair and Rebuild

Once the offer has been accepted:

- Engage licensed contractors to repair the property

- Submit copies of invoices, construction agreements, and receipts to the insurance company to get compensated (the payment can be made in installments.)

- Have a record of all dealings and expenses.

🧾 Step 8: Check Status of the Claim

Most insurers provide the facility for checking your claim status using the internet or a mobile application. Make sure to:

- Keep a check on the status of the claim

- Get in touch if things are not moving according to schedule

- Retain all emails and letters for your documentation