Published: June 2025

When most people think of their credit score, the first thing that comes to their minds is loans, credit cards, or buying a home. Nevertheless, did you know that in many U.S. states, your credit score can also affect how much you pay for car insurance?

Within this guide, we will cover all you need to know about insurers checking your credit and its impact on your premiums. You will also get useful tips on how to raise your credit score and in return, substantially lower your insurance costs.

🚗 Why Do Car Insurance Companies Look at Your Credit?

Insurance companies don’t access your entire credit report in the same way as a bank does. Specifically, the companies use a “credit-based insurance score.” This score forecasts your probability of needing to make a claim.

From records maintained by the insurance sector, if the driving behavior of clients with low credit scores is compared with that of the clients with high credit scores, the former are more likely to have claims filed. Moreover, it is not uncommon for them to have more costly claims too.

👉The insurance industry regards a high credit score mainly as an indication of fiscal responsibility.

💰 How Much Can Credit Affect Car Insurance Rates?

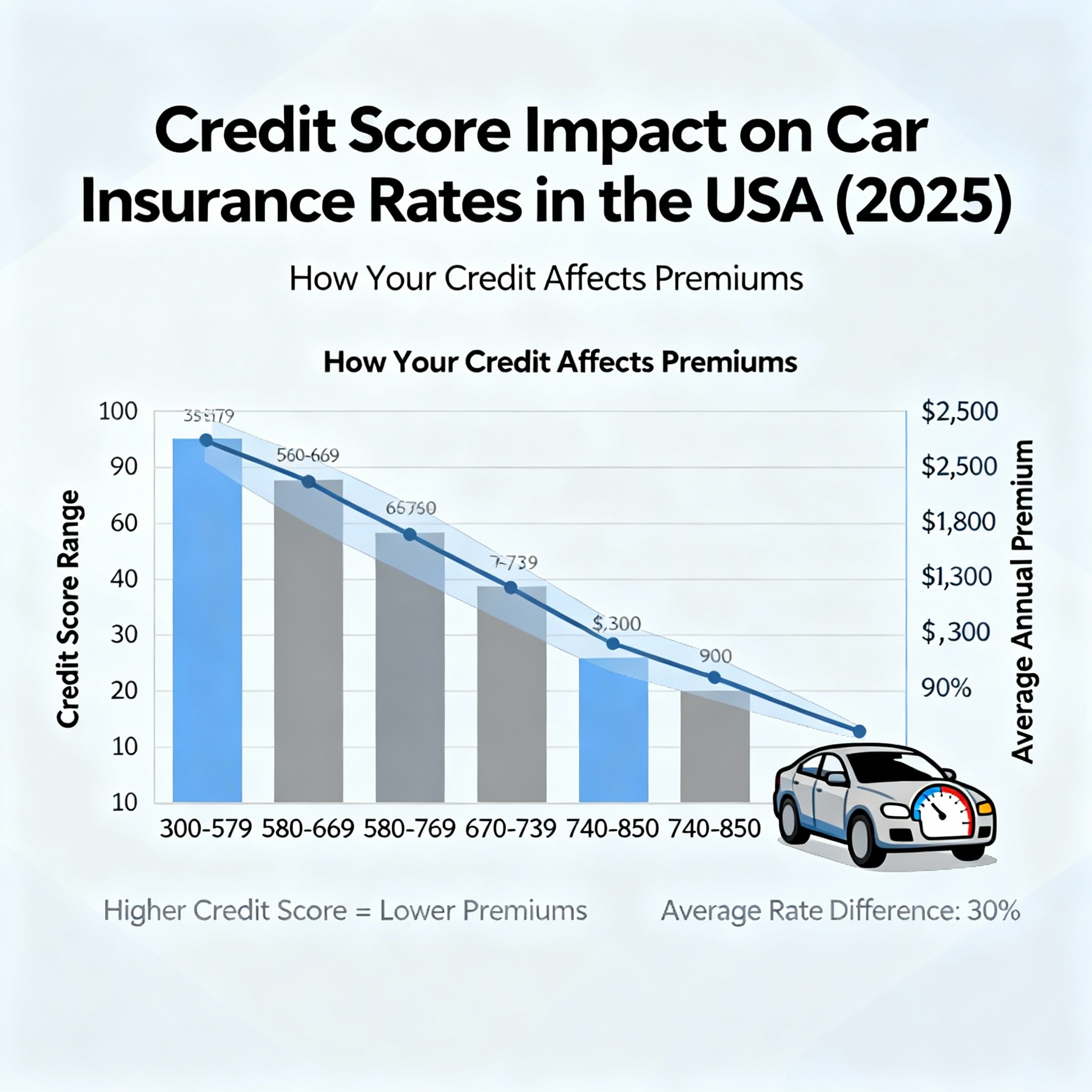

The impact of credit on your premium can be significant. In a few cases, the person with bad credit will pay 50-100% more than the one with excellent credit, and it can be just a case of a similar driving record.

Example:

- The picture below can explain this better:

- John has excellent credit: His premium is $900/year

- Sarah has poor credit: Her premium is $1,700/year

The same type of risk has been taken, while the costs are significantly different.

📍 Which Are the States That Allow the Use of Credit Scores for Insurance?

All the states do not permit car insurance scores to be used in the determination of their rates.

Prompt – The states that prohibit or restrict the usage of credit scores are:

- California

- Hawaii

- Massachusetts

- Michigan (in part)

- Washington (current situation)

Insurers from other states also have the legal right to utilize a credit score to indicate their price to a certain extent.

🔍 Which Aspects Of Your Credit History Affect the Premium of your insurance?

Although the income or the job position is not noted by the insurers, they may think about the following:

- Payment history (on-time vs. late payments)

- Outstanding debt

- Credit utilization (how much you owe vs. your credit limits)

- Length of credit history

- New credit inquiries

The points they require not are as follows:

- Your actual credit score (FICO)

- Why your score dropped

- Your full credit report details

✅ Ways to Make Your Credit Better and Lessen Your Premium

Improving your credit can be of great advantage to both your insurance rates and your whole financial life. Below is what you can do to achieve this:

- Pay bills on time: Late payments can hurt your score quickly.

- Keep credit card balances low: Stay under 30% of your credit limit.

- Avoid opening unnecessary new accounts: Too many inquiries can reduce your score.

- Review your credit report regularly: Correct any errors with the credit bureaus.

- Be patient: Credit score improvements take time, but they’re worth it.

🧾 Can You Still Get Affordable Car Insurance with Bad Credit?

That is true you can. Car insurance rates could be higher with bad credit but the following measures enable you to still get the insurance.

- Compare multiple insurers (some weigh credit less heavily than others)

- Look for discounts (safe driver, low mileage, multi-policy, etc.)

- Increase your deductible to lower your premium

- Drive a low-risk vehicle with low repair costs

📞 You can call the insurance agents yourself and explain your case directly to them — some of them may give you more personal suggestions or provide you with alternative policies.